Small Business: Cloud Accounting is Here to Stay

The speed we do business has never been faster, and it’s only going to increase. Cloud accounting is now a staple in present day business operations, for any size of business.

Right now, cloud accounting software—from leaders in the industry, QuickBooks and Xero—exists on a centralized server that is always connected to the Internet. Because of that, you can access that information from any device with a web connection; be it your laptop while you’re in an airport lounge or your mobile phone while you’re in a client's office or your tablet that you keep by your bedside at night or, yes, the computer in your office. The choice is yours.

But in the end, it’s exactly that; a choice, and one that should not be made lightly. If you really want to know why you should use cloud accounting software, or even if you should do so at all, you’ll need to keep a few key things in mind.

The Advantages and Disadvantages of Cloud Accounting

Once you've learned as much as you can about what cloud accounting can actually do, it's time to move into the realm of figuring out exactly what it can do for you. The question of whether or not this is the right move for you to take is ultimately one that you and you alone can make. By examining the subject from the perspective of both positives and negatives, you'll be in a better position to make the right decision for your own goals at exactly the right time.

For starters, the good. The cloud is often a major advantage to businesses that are just starting out in particular, as it often provides them the flexibility they need to manage accounts from anywhere, any time, and in any way. All you need is a mobile device, an Internet connection, and the right piece of accounting software and you can manage the entire financial side of your business just as effectively while you're stuck in traffic as you can behind your desk in your office.

Cloud accounting is also great for collaboration, which is particularly helpful if you don't have one single person who has been tasked with managing business accounts. Not only can multiple users have access as needed from any location, but they can also communicate and work together so that everyone can stay on the same page in terms of financial activity. The same is true if you’re working with a dedicated accountant, as the cloud can essentially give them real-time visibility into a business for a level of insight they just wouldn’t have through other means.

Another one of the major benefits of cloud accounting is that the types of software you’ll be using can typically be easily integrated with other aspects of your infrastructure that have already made the jump. In the past, you were likely dealing with silos that hampered productivity and made routine administrative tasks take longer than they really should have. Invoicing payments, general accounting, payroll and even HR were all probably totally separate elements. Now, with everything in the cloud, data can be shared freely, and information is available in an instant - perfect for breaking down those silos once and for all.

Now, none of this is to say that the cloud has NO disadvantages, far from it. To begin with, the actual process of moving from your existing system and into the cloud will hardly be as simple as flipping a light switch. If you’re staying with software from the same company, that's one thing. If you’re not, you’ll need to prepare your data so that it can be seamlessly integrated into the new system. A new piece of software may require different naming conventions or different arrangements of columns and rows, for example. This won’t necessarily be the most challenging task you'll ever face as an entrepreneur, but it certainly won't happen overnight either.

You also have to think about whether or not you’re comfortable with the fact that you’re giving up a certain level of control over your data to a third party. All of your financial information will no longer be stored on a hard drive in your office; it will be on a server that could be halfway around the country (or the world). If your provider gets hacked, you get hacked. If your provider is disconnected, you’re disconnected. If your third-party vendor isn't in compliance with any industry-specific regulations that you have to adhere to, guess what - neither are you.

All of these are challenges that can certainly be addressed, but they also represent a fairly significant change from the way you're probably used to doing things. Again, this is not a decision that anyone else but you can make. Most small business owners in particular will absolutely benefit from the advantages that cloud accounting brings with it... but some won't.

Don’t look at cloud computing as a solution in search of a problem. You’ll know when it's time to make the jump by recognizing a number of real problems that you’re facing that cloud accounting represents the perfect solution to.

Xero vs. QuickBooks

Both Xero and QuickBooks are leaders in the cloud accounting software market in the US. QuickBooks (QB) has been in the market for longer than Xero, is very well-developed, and is generally loved by accountants. With the QB cloud-based system, businesses also love the software and can streamline many of their repetitive tasks and processes by managing bills and invoices, tracking projects, and even tracking miles automatically with a smartphone. Whereas, Xero manages to make accounting sleek and enjoyable. Xero is incredibly user-friendly, simple and powerful, and is designed to help their customers do better in their own businesses via their accounting tools. Xero also tends to be more popular in the startup world than QuickBooks.

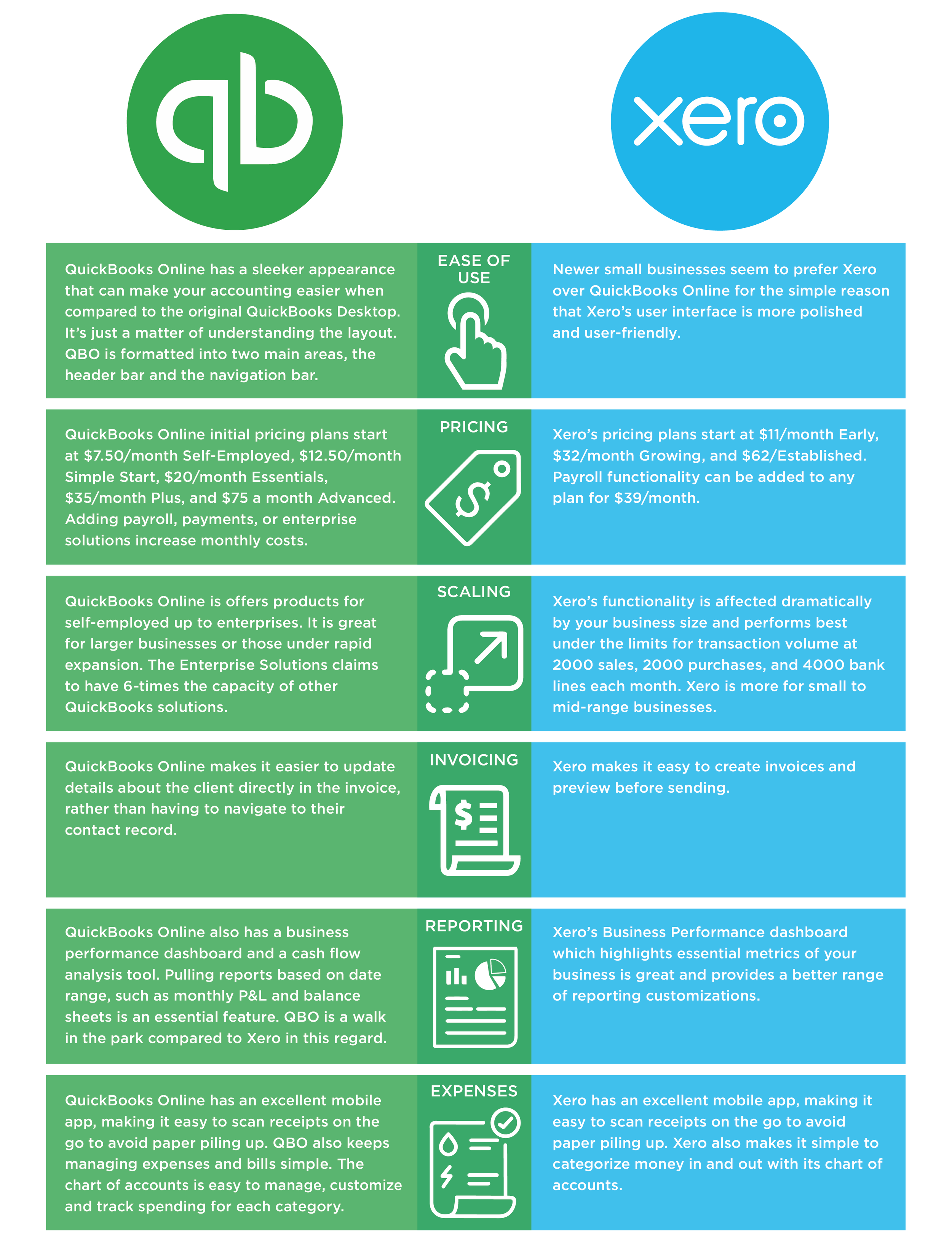

Here is a comparison chart between key factors when deciding which cloud solution is best for your business:

The fact of the matter is that cloud accounting certainly isn’t going away anytime soon. QuickBooks and Xero aren’t the only two options for accounting, do your research and find the best solution that is aligns closely to your business operations and goals. It is in your own best interest to begin that process as soon as possible, every type of business has gone digital.